Free Credit Repair Software

We help fix your credit by making the hard things simple.

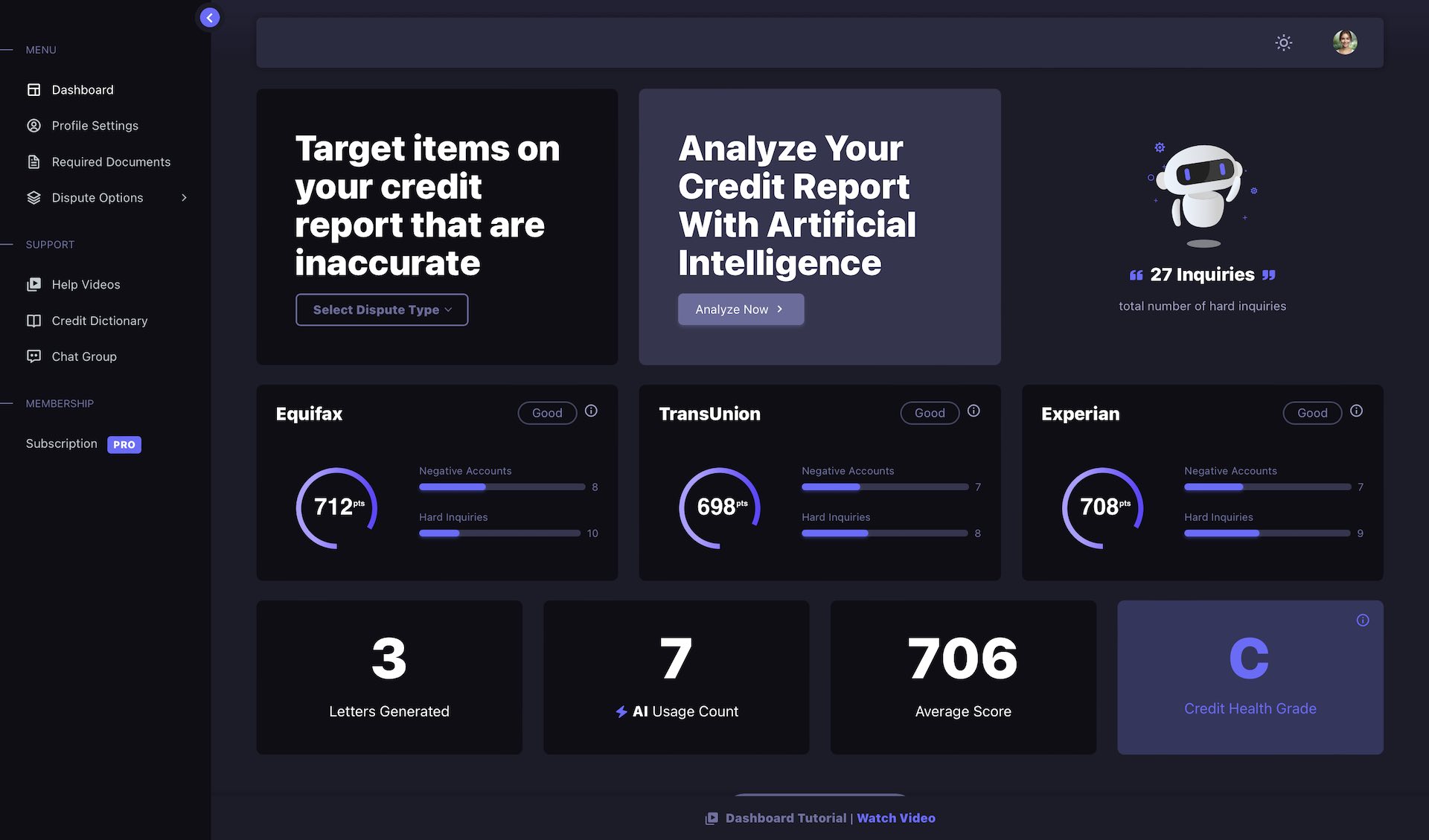

Increase Your Credit Scores

Say goodbye to those pesky negative items on your credit report with our powerful DIY credit software. Experience the ease of boosting your credit score like never before. The days of paying expensive credit repair companies are over. Start boosting your scores today!

-

Dispute Inquiries

-

Dispute Accounts

-

Dispute Public Records

-

Dispute with Creditors

-

Freeze Credit Reports

Easy For Beginners!

Our diverse user base spans generations, reflecting the wide appeal and effectiveness of our services. We're proud to have supported hundreds in achieving significant improvements in their credit scores. With our user-friendly software and the collaborative support of our community chat group, we ensure a smooth and supportive journey towards better credit for everyone.

Simple Steps to a Better Credit Score

We made it easy to understand your credit report and dispute negative items. The hard parts are done for you, so you can focus on the things that matter.

-

Notification Changes

-

Easy Navigation

-

Video Tutorials

-

Community Chat Group

-

Prepared Letters

Credit Repair & Artificial Intelligence

Our AI analyzes your credit report and can provide insightful information for optimal decision-making. Give it a try, hit the switch below!

Any questions?

Check out the FAQs

Still have unanswered questions and need to get in touch?

We Respond Quickly

Chat with us

Our software is for anyone that wants to improve their credit score. It doesn't matter if you have a 300 or 800 credit score, we can help you improve your credit score by potentially removing negative items from your credit report.

Yes, the free option is really free. You can use your credit report from the many different free credit report providers, then manually enter your credit report data into our software.

It depends on your credit report and how many negative items you have. We have seen results in as little as 30 days, but it can take up to 90 days to see results. We make no guarantees on how long it will take to see results since every credit report is different.

Yes, you can cancel your subscription at any time without contacting us. Simply login to your account and click the cancel button. You will still have access to your account until the end of your billing cycle.

Yes, your data is safe. We use the latest encryption technology to ensure your data is safe and secure. We do not sell or share your data to any third parties.

Credit Scores Matter

A higher credit score can help you get approved for a loan, even if you have low income. Having a lower interest rate can save you thousands of dollars over the life of your loans.

Many Americans have less than stellar credit scores, and it's costing them thousands of dollars every year. Let us help you get your credit score back on track with our free credit repair software.

See how your credit score is calculated by the 3 major credit bureaus.

35% of your score is based on your payment history. This is the most important factor in your credit score. If you have missed payments, your score will be impacted the most by this metric.

30% of your score is based on your credit utilization. This is the amount of credit you are using compared to the amount of credit you have available. If you are using a lot of credit, your score will be lower. Try to keep your credit utilization below 30%.

15% of your score is based on the length of your credit history. This is the amount of time you have had credit. If you have had credit for a long time, your score will be higher.

10% of your score is based on the types of credit you have. This is the different types of credit you have. If you have a variety of credit for example - credit cards, auto loans, and mortgages, your score will be higher.

10% of your score is based on new credit. This is the credit that you applied. Although a necessity, inquiries stay on your credit report for 2 years, so try to avoid applying for new credit if possible.

Who Are We?

Who Are We?

Please Wait

Please Wait